Succeeding as an FMCG brand is becoming increasingly difficult. The growing competition makes securing a successful spot on the shelf harder, changing consumer needs demand flexibility, and media fragmentation makes it increasingly difficult to reach that one shopper.

A striking and attractive packaging, a good price, a positive brand image, and a solid set of brand assets are the key factors for success. And since 80% of products don't even make it to the end of the first year, it's crucial to have these things in order.

But how do you ensure your packaging stands out and encourages purchase? What exactly is the optimal price at the equilibrium of demand and sales? And what do people really think about your brand?

There is only one way to find answers to such questions: market research. And if you execute it well, it can significantly boost your brand's sales and profitability.

But what is good market research? And how do you prevent not seeing any return on those invested euros in market research?

Market Research & FMCG: The Right Tools for the Right Question

Let's start with the basics: Market Research. The term is so broad, and the number of market research agencies - and the different forms of market research - makes it difficult to grasp at a glance what you can expect from such research.

All agencies and methods claim to have the answers to your questions. But if they all use a different method, it’s impossible to make all those choices consciously; we simply don’t have enough time or mental energy. An important question is then - whether you are going to conduct market research yourself or want to have it done - "what exactly do I want to investigate?" (and I promise you: this question is simpler to answer than it might seem 😇).

Even if you go for a market research agency, it is still important to have your answer to this question clear first. That makes choosing a suitable research agency a lot easier.

To answer that question, it is important to take a good look at your target audience. Don't worry, we don't mean an extensive analysis of strictly separated segments or even individual personas. Just look at the target audience as a whole. As an FMCG brand, this is often quite simple; your target audience is the shoppers. With market research, you want to gain insight into the choices of the person who buys your product: the shopper. Your sales are directly dependent on whether the shopper chooses your product.

Let's zoom in on that. Because we secretly already know quite a bit about the choices of shoppers. This is because extensive research has been done on it in the past. There are numerous renowned researchers who deal daily with how shoppers make choices. To keep it simple, we share the three most important insights so far.

1. Shoppers are irrational

Let's get straight to the point: we humans are incredibly irrational in many of our choices. The reason for this is that we are presented with about 10,000 choices a day. From "should I stay in first gear or shift up?" to "which product should I take from the shelf?". You can imagine that we cannot make all those choices consciously; we simply don't have enough time and energy for that. Imagine if you still had to think about every action you take when you're in the car; we'd already be tired when we arrived at work.

Anyway, to deal with that enormous number of choices, our brain has created all sorts of mental shortcuts that allow us to make many choices on autopilot now. That's handy; it saves us brain capacity needed for more important matters. But it also makes us vulnerable to all sorts of external influences that steer our choices - without us noticing.

2. 70% of purchase decisions are made in-store

Apparently, making a shopping list and sticking to it is only for a small part of shoppers. Because research shows that no less than 70% of purchase decisions are made after the shopper enters the store. This means that in-store, there are numerous factors that can direct the attention of shoppers and tempt them to buy a product.

This clearly shows the importance of your packaging and price. In that split second when the shopper makes their choice, it is those factors that make the difference between ending up in the shopping basket or seeing your neighbour end up in the shopping basket.

3. People are incredibly bad at predicting their own behaviour

That we humans are incredibly bad at predicting our own behaviour has long been clear in science. This is evident from an experiment with - do you remember them? - walkmans. Researchers showed two walkmans to a number of individual test subjects; a yellow one and a grey one. They asked the participants which one they would prefer because they wanted to know which product they could best bring to market. The majority of the people chose the yellow walkman. Experiment done - at least, that's what the test subjects thought. Because then the researcher told the test subject that they could no longer use the walkmans to sell - after all, they were already unpacked - and indicated that the test subject could take one with them at the exit. What turned out? Most went for the grey walkman.

The reason for this? When the researcher explicitly asked the test subject which walkman they would prefer, the test subject made a rational and conscious choice. While when the researcher indicated that the research was over and the test subject could take one with them, it was precisely that unconscious mindset that was active, in which the test subject made a completely different choice.

Another great example that shows that people often say something different than they actually feel is seen in the Coca Cola vs. Pepsi challenge, which we recently did with our own Tim.

What walkmans have to do with market research...

The same applies to market research; as a market researcher, you can explicitly ask what the shopper thinks of a product, but that says nothing about whether that person will buy that product or not.

The rule of thumb is; research your target audience in the right mindset. Just as it is of little use to drive a screw into a plank with a hammer, it is also of little use to investigate a choice with an explicit method that pushes the test subject into a conscious mindset, which is normally made in an unconscious mindset.

We are not saying that explicitly asking questions does not work; it can work very well, but only for conscious behaviour. For example, when you want to investigate why parents choose a particular school, traditional methods such as questionnaires are the best option. Such choices are made consciously and rationally considered, making it easy for people to answer why they go for a particular choice.

However, when the target audience normally chooses unconsciously, as is the case in the supermarket, it is of no use to investigate them in a conscious mindset.

Neuromarketing Research - How to Research the Unconscious Shopper

Now that we know that shoppers' choices are often unconsciously influenced by various factors and take place on an unconscious level, we also know that explicitly asking questions - just like with the discman - offers little predictive value for sales.

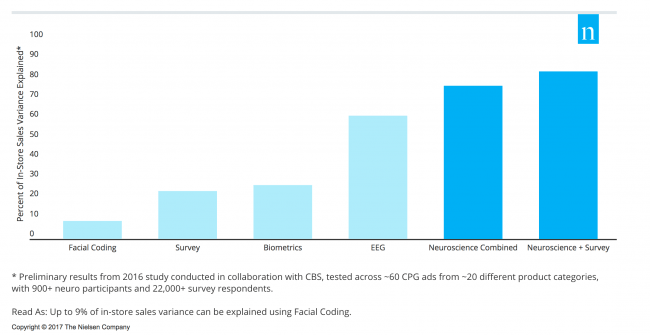

With neuromarketing methods such as EEG, we are able to research shoppers in that unconscious intuitive mindset. As a result, the predictive value of neuromarketing research is much higher than many traditional methods. A large-scale experiment by Nielsen (2016) beautifully demonstrates this:

In the graph, Nielsen shows the results of this research. What turns out? Where the predictive value of questionnaires is around 20%, the predictive value of EEG is around 60%. The best result came from a combination of EEG and questionnaire, with a predictive value of almost 80%. This is not surprising, as you measure both the conscious and unconscious reactions of test subjects in this way.

In the FMCG industry, we often use Eye Tracking and EEG. This way, we can not only see where someone is looking but also what they feel about it.

So, which method in the FMCG sector?

When choosing a method or research agency, it is important to ask yourself whether your target audience makes their choices unconsciously or consciously. This way, you can make a choice between two streams: traditional market research and neuromarketing research.

The unconscious mindset with which shoppers make choices in the retail sector makes neuromarketing a reliable method for this sector. Precisely for this reason, neuromarketing research is becoming increasingly popular among FMCG marketers.

Gratis Webinar: Zo voorkom je Redesign Rampen🧠

Elke verpakking is vroeg of laat toe aan een nieuw likje verf. Je wilt met die nieuwe verpakking natuurlijk meer aandacht grijpen en vaker in het winkelmandje terechtkomen. Echter, soms gaat het mis. Hoe voorkom je Redesign Rampen? In dit webinar krijg je exact inzicht in welke psychologische factoren een redesign maken of breken.

👉 Hoe zorg je ervoor dat jouw merk vindbaar blijft?

👉 Hoe voorspel je de effectiviteit van een nieuw design?

👉 Wat hebben cases uit de praktijk ons geleerd?

De 60 minuten durende webinar is nu terug te kijken!

Bekijk de webinar via deze link <

The Five Most Popular Applications of Neuromarketing in the FMCG Industry

Now that we have discussed how to conduct market research and what to consider when choosing methods, it's time to dive into the five most popular applications of neuromarketing within the FMCG industry.

For a complete overview of what Unravel does within the FMCG & B2C industry, you can visit here:

Neuromarketing research & FMCG

1. Neuro Packaging Research

One of the most important factors in a product's success is the packaging. The packaging must grab attention in that well-stocked shelf, be recognisable, and encourage purchase.

Attention influences purchase decisions and is therefore linked to sales. In fact, research shows that when shoppers make quick choices, visual attention influences choices more than preference does (Milosavljevic et al., 2012).

Neuro packaging research is conducted using Eye Tracking and EEG. This way, we can precisely see if the packaging stands out and what the shopper feels about the packaging. We do this in-store or through a digital display of different shelf layouts.

The most important brain metric we use is desire. It turns out that this metric predicts buying behaviour. We not only look at whether the packaging as a whole encourages purchase but also at different elements within the packaging such as claims, logos, and visual elements. This way, a packaging research report always offers concrete improvement points to increase sales.

The importance of packaging research became painfully clear to Tropicana. They introduced new packaging, which unintentionally caused sales to plummet by 20%. Tropicana’s mistake was that consumers no longer recognized it as Tropicana. Even though the logo was still on the packaging! Such mistakes can be avoided by testing your packaging first.

![]()

Neuro Packaging Research in our living room lab

Want to know what such a packaging research report looks like?

👉 Click here to download a sample report directly

Oh, and if you're interested, here are two interesting blogs about neuromarketing & packaging:

- Is your Packaging Due for a Redesign? How to Prevent a Redesign Disaster

- With this New Psychological Technique, Your Packaging Stands Out 69% More on the Shelf

2. Neuro Pricing Research

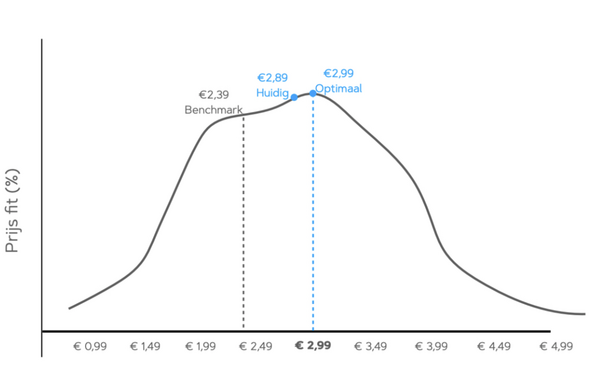

Although you might think that when you raise the price, demand decreases, this is not always the case. Because you know by now; shoppers are less rational than thought and process prices less rationally than you think.

This is evident from the price indifference effect; an effect we often see in the supermarket. Within a certain range, shoppers simply don't care much about the price because they can't consciously remember the exact price. There is often a relatively wide range between when a product is too expensive and when a product is too cheap; an "area-of-indifference".

However, if you go beyond the boundaries of this area with your price, you can expect a significant drop in demand.

Neuromarketing Pricing Research is the form of market research that can objectively reveal this area-of-indifference. Through EEG, we can precisely see what the optimal price for your product is and how you can maximise your profit.

Want to know what a pricing research report from Unravel looks like?

👉 Click here to download a sample report directly

And here are two blogs about Neuromarketing & Pricing:

- How to Ease the Pain of a Price: Insights from Psychology

- Pricing Research - How to Determine the Perfect Price in the Brain 🧠

3. Brand Image & Brand Asset Research

Continuing on the packaging of Tropicana; having a strong set of brand assets is essential for FMCG products. These brand assets ensure that your product is recognised in the store, and that your advertising messages are actually linked to your product in the store. If that doesn't happen, the effort and costs you put into advertising are a lost cause.

Distinctive brand asset research measures the strength of your brand assets on their fame and uniqueness through an online questionnaire (including IAT). Based on the performance of your brand assets, you receive practical recommendations for further growth. At Unravel, we can also help you develop strong brand assets.

Want to know what a branding research report from Unravel looks like?

👉 Click here to download a sample report directly

My colleagues have also written some great blogs about branding:

- The Ultimate Brand Asset Guide: Everything You Need to Know About Brand Assets

- The Marketing Psychology of Coca-Cola

4. Advertising Research

Television is still one of the most important platforms to reach consumers and thereby increase your product's sales. But advertising is also largely processed unconsciously. For example, a neuro advertising research on Coolbest showed that one specific scene from the commercial might have received positive reactions when asked consciously, but the desire in the brain actually dropped significantly (and desire is what predicts buying behaviour). When Coolbest removed the scene, the entire commercial was experienced very positively!

In this short video, Tom explains how neuromarketing advertising research works:

I'll briefly write it out for you. With EEG and Eye Tracking, we can see on a millisecond level what the advertisement does in the brain on four important neuro KPIs: attention (whether the commercial grabs attention), desire (predictive of buying behaviour), workload (the amount of effort the brain has to make to process the commercial), and engagement (how relevant the advertisement is). This way, we can precisely see which scenes increase sales and which do not. This allows us to predict sales and provide practical tips to increase the impact of your advertisement.

We can already give away one tip, as it is of great importance specifically for the FMCG industry. The rule is: Use mental cues between the advertising moment and the purchase moment. In other words: elements that appear both in the advertisement and on the packaging, allowing shoppers to link the positive associations from the advertisement to your product in the store and buy the product faster (Hello, Whiskas Cat).

An example of neuromarketing advertising research with EEG

Want to know what a branding research report from Unravel looks like?

👉 Click here to download a sample report directly

Curious about Neuromarketing & Advertising? Then this blog is good to read:

5. Shelf Research & Neuro Customer Decision Tree Research

As an FMCG brand, you sometimes - to a greater or lesser extent - have influence over where your product is placed on the shelf. Now that we know that attention is so incredibly important, you can imagine that the location of your product on the shelf is an important driver of sales.

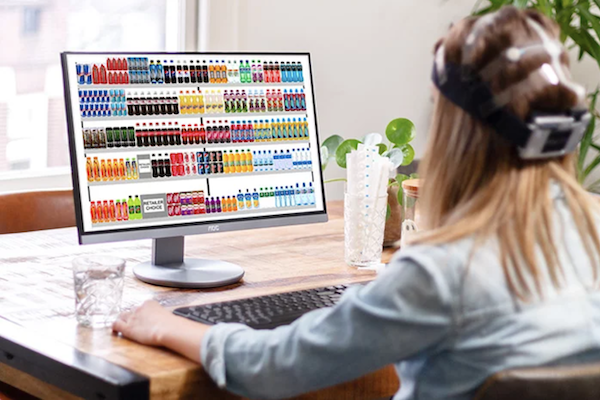

In a Neuro Shelf Test, we test multiple shelf layouts for their effectiveness using Eye Tracking and EEG. We do this by showing digital versions of different shelves. We test two characteristic forms of shelf interaction for each shelf variant: goal-oriented searching (where the test subject is instructed to find a specific brand, segment, or usage purpose) and free choice (where the test subject is instructed to look around freely and choose a product of their choice). This way, we can precisely see within that unconscious mindset which spot on the shelf gives your product the biggest sales boost.

Additionally, we regularly conduct Neuro Customer Decision Tree research for FMCG clients. In these types of research, the shopper's decision-making process is central, and we unravel what the most important decision factors are for the customer in-store using Eye Tracking (possibly supplemented with EEG). This way, we find out how your product can be optimised.

Here are two blogs about Neuromarketing & the shelf:

An example of a neuro shelf research with EEG

Curious about how we can use neuromarketing for your brand?

Those were the five most popular applications of neuromarketing within the FMCG industry. Would you like to have a non-binding and free consultation about how we can use neuromarketing for your brand after reading this blog? Feel free to contact Tim.

EN

EN  NL

NL