Imagine this.

You have an idea. Perhaps for a new product, a new packaging, a new layout for your shop, or even a completely new company. Or you want to improve or optimise something like an advertisement, a website or app, or your company's branding.

You naturally think it's a good idea; after all, you came up with it yourself.

But are people really waiting for your new product? Will the new layout or advertisement catch on? And where do you start with optimisation?

Market research provides answers to those questions. Simply put, market research shows whether your new or improvement plans have the potential to become successful.

Because this has become quite a long article, I have added a table of contents especially for you. This way, you can quickly navigate to the part that is important to you.

Table of contents

- What is market research?

- Questions that can be answered with market research

- Why is market research important?

- How does market research work? The main methods in market research

- Which method is best for market research?

- Neuromarketing: Increasingly popular among brands

- Examples of Market Research with Neuro

- Outsourcing market research

I. What is market research?

Market research involves conducting research with the aim of obtaining information about the market and your target audience. By gaining more insights into the market and the target audience, companies can design better products, improve the user experience of websites, or test the potential of a new product or packaging.

II. Questions that can be answered with market research

By conducting market research, you can gain insight into who your customers are and what their desires or needs are. You can also get answers to questions regarding the potential success of specific products or communication tools. Examples of questions that can be answered with market research include the following:

- Will my new product or packaging catch on?

- How does my target audience view my company or product?

- What problems do customers encounter when interacting with my company?

- How can I improve my product, packaging, advertisement, app, or website?

- How do I increase the conversion of my shop or webshop?

- What is the right price for my product?

III. Why is market research important?

Did you know that 80% of new products fail? And that 40% of advertisements actually decrease the sales of the product? And this while millions are spent on developing new products and advertisements.

If proper market research had been conducted prior to every product launch or advertisement, these figures would have been much lower.

Market research is important because it is the only way to gain insight into the market and the consumer. And that drastically increases the chances of your plan succeeding.

Market research removes the uncertainty surrounding new ideas or improvements, giving you more certainty about the future effectiveness of your plan.

IV. How does market research work? The main methods in market research

IV.I. Surveys

Surveys, or (online) questionnaires, are a commonly used way of conducting market research. You simply send a questionnaire to your target audience to gain insight into who they are, what their needs are, or what they think of your (new) product, communication tool, or brand.

Surveys are popular because they are cheap to conduct and because you can quickly collect a lot of data. However, it is important to know that surveys can also give a distorted view of reality, because people think much more rationally when filling out a survey than they often would in purchasing situations.

No less than 90% of our choices are made (partly) unconsciously.

Therefore, in certain situations, there is a high chance that a questionnaire will present a distorted view of reality. People often do not say what they do, and do not do what they say. Not because they want to lie, but because they simply do not know.

Imagine. I ask you which brand you prefer to buy; Adidas or Nike. Probably an easy question. But the question of why you prefer that brand is already more difficult.

You can probably partly explain that by the quality of the products and the price of the products, but isn't a large part also just the feeling you have with a certain brand? And how do you describe that feeling exactly?

A great example of this can be seen in this episode of "In the Brain", where we put an EEG on Tim during the classic taste test: the Pepsi vs. Cola vs. Store Brand Challenge.

What turned out? When blind tasting the colas, the store brand produced the most positive emotion in his brain, but when the brands were visible, this was with Pepsi cola. While when we asked him after tasting which he liked best, he went for Coca Cola. Well, you wouldn't have been able to find that out with a simple questionnaire!

Later in this blog, you will read more about when questionnaires are the best option and when they are not.

IV.II. Interviews and focus groups

In interviews and focus groups, you use conversations with your target audience. In an interview, this happens one-on-one, in a focus group you talk to several people at once. Interviews and focus groups therefore use a smaller group of people whom you question more extensively than you would in a survey.

The advantage of this is that you get an extensive opinion from people. But there are also a number of disadvantages to this method. The first disadvantage is identical to the biggest disadvantage of questionnaires; you let people think rationally again about situations where they normally do not think well. Again, a distorted view.

Secondly, with interviews and especially with focus groups, you have even more of a problem than with surveys that you get socially desirable answers. In other words; the presence of the researcher (or interviewer) ensures that people say different things than they actually think.

In focus groups, this problem is even greater, because people often let their opinions be influenced by others. And as a result, the chance is even smaller that individuals in the group will share their own opinion with you.

That's actually not so strange; we all know a situation where someone is wearing a new dress and asks what you think of it. You will probably honestly tell your own friend that you don't like it, to say the least, but would you say that so directly to your neighbour? Or would you wrap it in a slightly more subtle way?

One piece of advice is that if you go for interviews, you should have this interview conducted by an independent party. This way, respondents do not unconsciously feel guilty if they say something you as an interviewer did not hope for. Although that independent party will probably already (unconsciously) influence the responses of the respondents.

IV.III. Neuromarketing

A relatively new method of conducting market research is through neuromarketing techniques. This way of conducting market research has become very popular in recent years. Not surprisingly, because the opportunities and promises of neuromarketing research are impressive.

Where questionnaires and interviews focus on the rational and conscious side of the consumer - read: you ask a question, the respondent thinks about it briefly and gives an answer - neuromarketing techniques measure the unconscious of the consumer.

And since the consumer makes her choices unconsciously (in 90% of cases at least), this form of market research would offer much more reliable results.

By measuring the unconscious of consumers, neuromarketing bypasses socially desirable and overly rationalised answers and instead provides an objective look into the consumer's decision centre: the brain.

An additional advantage of neuromarketing techniques is that you need a relatively small sample to obtain reliable reproducible data. Most neuro-studies are conducted with 20-30 respondents.

For example, in one of our studies, we found that with the brain data of only 22 participants, we could predict as much as 71% of the election result!

The most used neuromarketing techniques are EEG, fMRI, and Eye Tracking. Want to know more about these techniques and their pros and cons? We have already written a blog about the key differences between EEG and fMRI, and a complete guide on eye tracking.

One of the most used neuromarketing techniques: EEG

IV.IV. Observation

The last and perhaps most powerful method for market research is objectively observing behaviour. During the observation of behaviour, you look precisely at what an ideal or potential customer does while engaging with a product, a website, a packaging, a shelf, etc.

Behaviour predicts behaviour, so you could look at the behaviour of a number of people in a situation to predict what a larger group of people will do.

However, situations where you can objectively measure behaviour do not often occur. How do you know, for example, if a particular advertisement actually causes people to go to the store? You simply cannot often track behaviour well, except in online environments such as on webshops.

Secondly, observing behaviour itself provides little implications for improvements or answers to the question "Why?".

Take a website. Using tools like Google Analytics or Hotjar, you can see, for example, that an x number of people leave their shopping cart without buying anything. And based on those people, you can predict that this will also happen with future visitors. But where it goes wrong or what you can change to reduce this percentage, you do not get an answer to by purely observing behaviour.

V. Which method is best for market research?

You might think after reading the above methods that neuromarketing always gives you the most objective and complete picture of reality.

But that is not entirely true.

Each method has its pros and cons. And each research question is different. Therefore, it is much too simple to name one method as the best.

Which method is best to get an answer to your question largely depends on the situation in which the consumer finds themselves. Simply put, you can divide these situations into two categories: conscious and unconscious. Rational and irrational. System 2 and System 1, as they are also called.

We already mentioned earlier in this blog that 90% of choices are made unconsciously. In those cases, emotion often plays a major role, and it is therefore important to measure this unconscious.

Neuromarketing is then very useful here, as it is the only way to objectively measure that unconscious. From a purchase in the supermarket to processing an advertisement and surfing on a webshop; we may think we do this consciously, but research really shows otherwise.

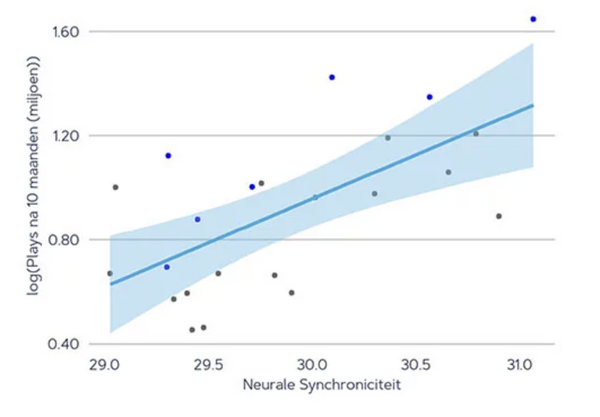

A case that beautifully illustrates this is our music research. In this study, we let respondents listen to a number of new songs and asked them to rate them. We also measured their brain activity with an EEG while listening to the songs. We then looked three weeks after the study at how many streams those new songs had received. Ten months later, we did it again.

What turned out? Although the subjective scores could not predict those Spotify streams, brain data could. Combined with a second factor (whether the song was released as a single or not), brain data explained as much as 62% of the variance in the popularity of a song on Spotify.

Simply asking questions is therefore of little use in situations where choices are largely made unconsciously - such as our music preferences - and that turns out to be the case 90% of the time.

Of course, that does not mean that about 10% of our choices are indeed thoughtful and consciously made. Often these are somewhat larger decisions, such as taking out a mortgage, buying a house, and opening a bank account.

For these types of "high-involvement" choices, it is more cost-effective to use traditional methods for market research, such as questionnaires or interviews. Because: an online questionnaire is simply faster and cheaper than an EEG scan.

That does mean that in most cases, neuromarketing techniques can predict behaviour better than traditional marketing.

A large-scale study by Nielsen confirmed this once again. In this study, they examined various research methods and looked at which of these methods are best able to predict purchasing behaviour. Both the old trusted questionnaire, facial coding, and EEG were subjected to a critical test. The response to dozens of advertisements was measured with each of these methods, after which the store purchases of the participants in this experiment were tracked for months.

What turned out? The traditional questionnaire was only able to predict 20% of purchasing behaviour. Facial coding predicted only 10%. But standing head and shoulders above the rest was EEG, which could predict as much as 60% of behaviour.

Does that mean we should immediately throw questionnaires out of our research toolbox? Certainly not. Because, if we combine EEG with questionnaires, we find that we can even predict 80% of behaviour.

The interesting thing about this difference, 60% for EEG alone and 80% for EEG and questionnaire together, also shows that these methods measure something different. Where EEG measures the unconscious, you can measure the conscious part of the decision-making process with questionnaires.

VI. Neuromarketing: Increasingly popular among brands

If you read the above insights, it sounds quite logical that more and more brands are switching from traditional research to neuromarketing research.

More and more studies show that EEG is the best option if you are looking for certainty.

VII. Examples of Market Research with Neuro

At Unravel, we conduct market research daily for brands like Heineken, Jumbo, and PostNL. We often use neuromarketing, but when valuable, we also often combine this method with other methods, such as interviews or observation methods.

Below are some examples of market research through neuromarketing.

VII.I. Increasing the effectiveness of your advertisement with Neuro Advertising Research

The influence of advertisements is unconscious and subtle. And that is why neuromarketing is the perfect way to objectively measure the effectiveness of advertisements.

By showing participants a commercial block with an EEG on and an Eye Tracker, we can not only predict the effectiveness of an advertisement but also increase it. Brain data obtained with EEG provides insight into the performance of your advertisement on four essential KPIs: attention, memory, emotion, and purchase activation. This brain data turns out - more than any other method - to strongly predict purchasing behaviour.

A while ago, we conducted such an advertisement research for Pearle, with which we improved the effectiveness of their advertisement by as much as 64.7%!

Want to see exactly how such an advertisement research works? Then also download the Neuro Advertising Research Sample Report.

In this sample report, you will find exactly how we conduct such research and we reveal real insights.

VII.II. Optimising your shop, price, or packaging with Neuro Retail Research

How do consumers navigate through a shop? What stands out and what does not? How do you make packaging as effective as possible? And what is the best price for a product?

These are all questions you encounter in the retail world, and with which we can provide clear answers using neuromarketing techniques.

Through neuromarketing pricing research, we can determine the ideal price. Through packaging research, we can measure the effectiveness of your packaging, and with shelf research, we can measure whether your product stands out and whether it encourages purchase when the consumer is in front of the shelf.

Recently, we conducted a study for NS on how the customer navigates through their Kiosk shops. Through this research, Kiosk knows exactly which parts of the shelf are well seen and which are less; how the customer makes their choice and how the customer experiences the different shop phases, from entrance to checkout. In this way, Kiosk was able to improve the shopping experience and increase turnover.

Curious about how a pricing research or packaging research works? Then download one of our sample reports.

VII.III. Conversion optimisation through Neuro Usability Research

How do consumers experience your webshop? What opportunities are there to make the website more user-friendly and increase the conversion rate?

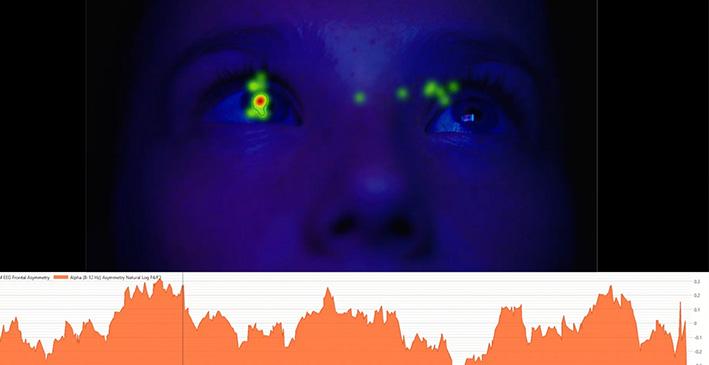

These questions are answered with Neuro Usability research, where we let participants interact with a website while they have an EEG on and we record where they look using Eye Tracking.

In this way, we can identify and eliminate the unconscious obstacles that stand in the way of conversion.

Want to know in what ways even Coolblue can still improve their webshop based on neuro insights? You can read the results of our research for Coolblue here.

In a Neuro Usability Research, participants interact with a website or app while we measure their brain activity and viewing patterns using EEG and Eye Tracking

VIII. Outsourcing market research

At Unravel Research, we investigate with Eye Tracking and EEG exactly what the customer does not tell you. In this way, we make advertisements, websites, and shops more effective.

Curious about how your brand can benefit from neuromarketing research? Tim will gladly show you how market research will never be the same again.

EN

EN  NL

NL